The power of compounding is a magical and monumental force which is available for you to leverage in your journey towards your future financial well-being.

Let’s understand its power.

Seed to Tree

Using the seed growing into a strong tree as my analogy, let me draw you a mental picture. You plant a seed today, next year it grows into a small plant which is yet weak since its not been able to grow as many roots. Give that small plant another 29 years, and one root at time, it has put down thousands of roots, some of which have grown into thick roots given that they were put down in year two and thus have had a chance to grow for 28 years. At the end of 30 years, the tree is majestic and very strong, with its branches giving shade to a large area around it. In addition, birds and squirrels build nests and rear their next generation, and it gives flowers and fruits that nourish others while standing tall for decades to come. Plant a seed of a US$ 1 or INR 1 or Euro 1 TODAY! And then watch it grow into your magnificent tree that gives shade and nourishment :).

Commitment, Time, and Patience

If you can commit yourself to the discipline of saving on a regular basis, no matter how small the amount is, then there are only two additional ingredients necessary for leveraging the power of compounding. These two ingredients are – Time and Patience.

Lets assume you have a period of 30 years of saving and investing available to you before you retire.

Then, let me demonstrate the power of compounding to you via the following examples.

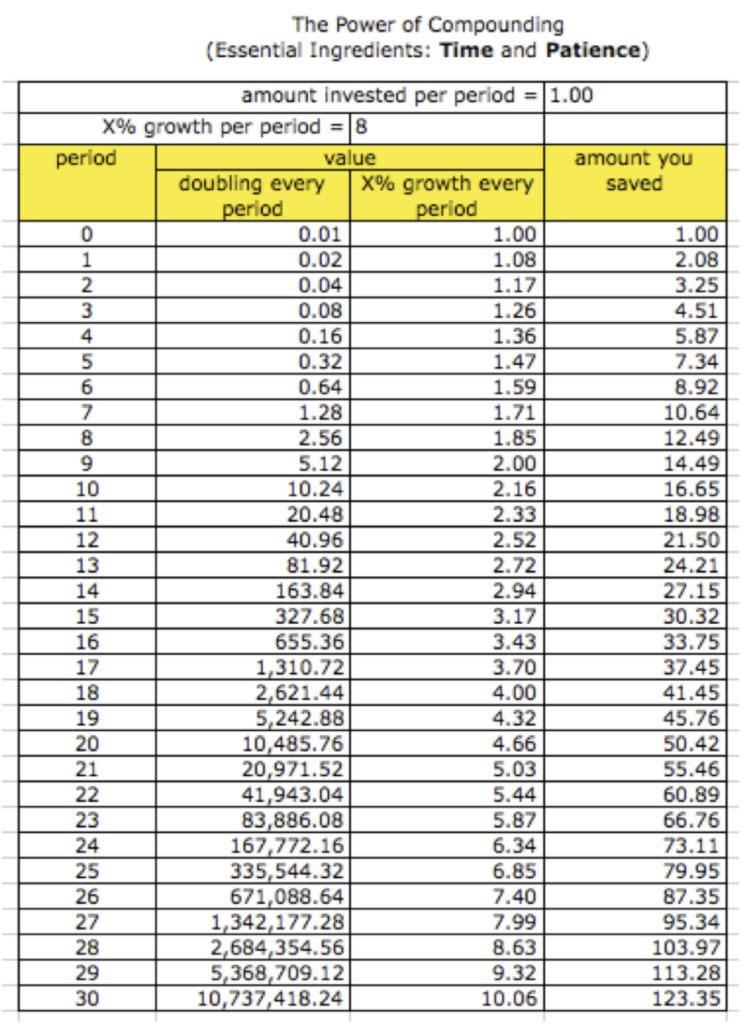

In the below pictorial, the column “doubling every month” shows that if you double US 1 cent every day for 30 days, at the end of 30 days you have collected US$ 10.7 million dollars! Shocked? I was when I saw that.

US$ 1 Saved, and Grows for 30 years at 8% per year

The S&P 500 Index of the US stock market has grown at a compounded annual growth rate (CAGR) of around 8% per year for more than 30 years. Let’s use that as the benchmark for our calculations. Thus, if you invested US$ 1 at the beginning of your first year, and that dollar grew every year by 8% for 30 years, your US$ 1 became US$ 10 without you having to do anything beyond saving that US$ 1 at the beginning.

US$ 1 Saved per year for 30 years, and Grows at 8% per year

Instead, if you invested US$ 1 at the beginning of every year, and it grows at 8% every year. Then, at the end of 30 years, you will have saved $123 (approximately). Did you realize that you only saved US$ 1 per year, totaling US$ 30 for 30 years. Compounding made that into a little over 4 times more, that is US$ 123 (30 x 4 = 120).

What if you save US$ 1000 per year (roughly US$ 84 per month)?

To extrapolate, if you saved US$ 1000 per year (approximately US$ 84 per month), then you will have saved US$ 123 x 1000 = US$123,000. Your savings of US$ 30,000 became a bit over US$ 123,000 after compounding for 30 years!

I urge you to start today without worrying that the amount you’re starting with is insignificant. The sooner you start, the more time you can give for compounding to take effect on your savings.

And, I’m certain you will find that US$ / INR / Euro 1 that you can save today, irrespective of your currency of savings. After its saved and starts compounding for you via your investment, few years down the road you’ll not even remember where or what you wanted to spend that 1 unit of money on. In my posts, I will point you towards how to put small amounts of money in the market, and start leveraging the power of compounding for you.

TODAY is a good day to start :)! Let’s make that start, please.

Examples of Power of Compounding:

Let me give you a real life example from my investments:

- Hindustan Unilever Ltd (HUL) – One of the largest blue-chip consumer packaged goods (CPG) company in India. Total return to date after 23 years of holding the stock has been 2,505%, or average annual return for 23 years has been 15.23% per year!

PLEASE NOTE:

- If you’re in an Emerging Market like India, then the stock market is expected to grow at a CAGR of 10.1 percent per year for the next 10 years as per Morgan Stanley. If that occurs, and lets assume that it will occur for another 20 more years, then instead of your US$ 1 or INR 1 or Euro 1 saved in the first year becoming US$ / INR / Euro 10, it will become nearly US$ / INR / Euro 18! And, your US$ / INR / Euro 1 saved every year for 30 years will become nearly US$ / INR / EURO 186, instead of 123! (Reference: https://www.business-standard.com/article/markets/india-s-equity-market-cap-to-hit-6-1-trillion-by-2027-morgan-stanley-118031200437_1.html)

- The above calculations are not precise, but meant to be sufficient to demonstrate the power of compounding with the ingredients of time and patience thrown in. If you find an error, please point it out, and I’ll be happy to correct it for the benefit of all of us.

Back to About Investments

Thank you for making it this simple to understand.